The Senate Judiciary Committee’s Subcommittee on Antitrust, Competition and Consumer Rights held a hearing last week to explore the competitive impacts of big tech companies’ massive string of mergers with smaller companies in the last handful of years. Before the Senate committee were experts in venture capital spending, the Federal Trade Commission (the agency tasked with merger reviews), and legal experts in antitrust law.

EFF believes a hard look and update of mergers and acquisitions policy is one of many actions needed to preserve the life cycle of competition that has been a hallmark of the Internet. In the past, the Internet was a place where a bright idea by someone with modest resources was able to be leveraged from their home into the next big innovation. We have lost track of that as a small number of corporations now control a vast array of Internet products and services we all depend on and now appear to have formed a kill zone around their markets where the incumbents target the new entrants through an acquisition or substitution by the incumbent.

Mergers With Big Tech Have Been Pervasive

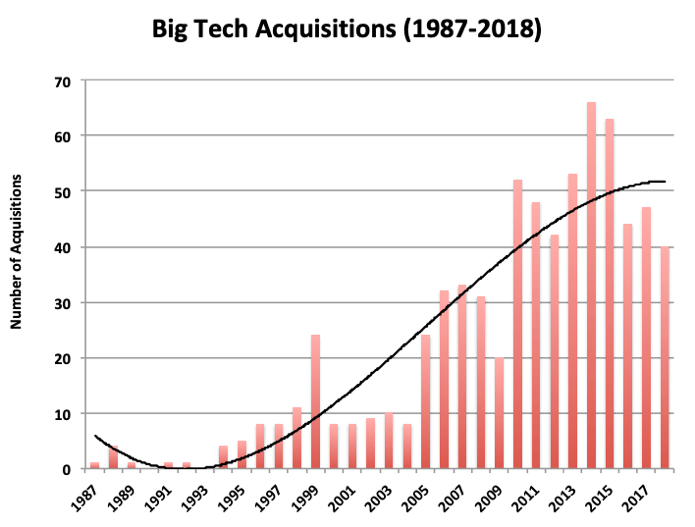

What is undeniable is that big tech companies have engaged in a massive number of mergers over the years. In testimony provided by the American Antitrust Institute’s (AAI) witness Dr. Diana Moss, the number of mergers engaged in by Google, Facebook, Microsoft, Amazon, and Apple are not only prolific but have been on the rise year after year (see below AAI's chart). And yet, big tech mergers according to AAI’s research faced fewer actually challenges from the government than other sectors of the economy. A variety of reasons were brought forth by the witnesses such as the inability of the law to properly screen Big Tech mergers that typically include a substantially smaller company being acquired or just that the impact on competition and innovation were not apparent at the time.

Market Dominance by Big Tech Has Changed Startups and Venture Capitalists

Securing investment from venture capitalists has been a major factor for startups getting off the ground and becoming major corporations. This is because launching a startup is inherently risky, so investment is assessed on risk factors. We actually have some compelling evidence that shows a relationship between risk and investment, one study showed reducing copyright liability in cloud computing increased investment by potentially up to a billion dollars in cloud computing startups. As committee witness Patricia Nakache, herself a General Partner at a venture capital firm with extensive experience in launching startups, noted, they fail on average three out of four times. With an already low odds of success, the added pressure of incumbents dominating a handful of markets has raised the bar for startups raising money when they seek to challenge the dominant players.

Arguably one of the most troubling issues the committee witnesses raised with the Senate Judiciary Committee is the fact that mergers and acquisitions are now seen as a primary driving force to securing initial investment to launch a startup. In other words, how attractive your company is to a big tech acquisition is now arguably the primary reason a startup gets funded. This makes sense because ultimately these venture capital firms are interested in making money and if the main source of profit in the technology sector is derived from mergers with big tech, as opposed to competing with them, the investment dollars will flow that way. This has not happened in a vacuum though, but rather is further evidence that antitrust law is in dire need of an update because lax enforcement has changed investment behavior.

The Lack of Competition Today is Not Frozen in Stone

The United States has been here before. The very existence of our antitrust laws and competition policy in other business sectors have sprung forth as a response to a less than adequate competitive landscape. In fact, antitrust law and competition law played integral roles in the telecommunications market where the then the world’s largest corporation, AT&T, was converted from a regulated monopoly into a regulated competitive market years later. But policymakers gathering a strong understanding of the market’s structure is a necessary first step and EFF will continue to support Congressional efforts to explore ways to improve competition in the Internet marketplace.